Introducing the Advantages of Automobile Financing

In the world of personal money, auto funding frequently emerges as a calculated tool that can offer people a variety of advantages past simple vehicle ownership. While numerous might check out automobile funding just as a technique to acquire a vehicle, its advantages extend much beyond the surface area. From lowering the first economic concern to possibly improving one's credit rating account, the landscape of vehicle financing holds many hidden gems waiting to be explored. As we explore the details of this monetary avenue, a deeper understanding of its complex advantages might surprise even one of the most seasoned monetary aficionados.

Lower Preliminary Financial Worry

Accessibility to Higher-End Autos

By choosing for automobile financing, people can get access to a broader option of superior cars that might have or else been financially out of reach. Lots of individuals desire of owning deluxe autos or high-performance vehicles, however the upfront cost can be excessive.

Flexible Settlement Options

When thinking about funding a lorry, people are frequently provided with an array of versatile settlement alternatives tailored to suit their financial preferences and scenarios. Extensive lending terms, such as 60 or 72 months, can result in lower regular monthly repayments, making it less complicated for people to manage their money circulation.

Potential Tax Advantages

Exploring the potential tax benefits linked with auto funding can offer individuals with beneficial understandings right into enhancing their economic methods. For people who use the car for organization objectives, such as freelance individuals or those who use their lorry for occupational travel, the interest paid on the auto financing may be tax-deductible. Used cdjr in Morris IL.

In addition, in many cases, sales tax on the acquisition of the car might likewise be tax-deductible if the individual itemizes reductions on their tax obligation return. This can be especially advantageous for those living in states with high sales tax obligation rates. In addition, if the lorry is used for organization purposes, specific expenditures associated with the car, such as insurance coverage, upkeep, and devaluation, might also be eligible for tax deductions.

Recognizing and leveraging these potential tax advantages can play an essential duty in minimizing tax liabilities and making the most of cost savings for people making use of car financing as component of their economic preparation.

Possibility for Credit Building

The possibility for credit rating structure through automobile funding is an important economic technique for individuals aiming to enhance their creditworthiness. When you fund a car, you have the possibility to show responsible loaning actions, which can favorably influence your credit rating gradually - New chrysler Morris IL. Making prompt repayments on your car finance reveals lenders that you are a dependable customer, potentially leading to an increase in your credit rating

In addition, diversifying the types of credit you have can also profit your credit report account. Including an installation lending, such as a car funding, to your credit score mix along with rotating charge account like credit scores cards can improve your creditworthiness. Lenders appreciate seeing that you can manage different kinds of credit score sensibly.

In addition, efficiently settling an auto financing can better enhance your credit history by showcasing your capability to commit to long-term economic responsibilities - jeep dealer near morris. This achievement can open up doors to far better credit rating opportunities in the future, giving you with a lot more beneficial terms on car loans and potentially conserving you money in the long run

Conclusion

To conclude, cars and truck financing supplies many benefits such cdjr finance in morris IL as reduced initial economic worry, accessibility to higher-end cars, adaptable repayment options, prospective tax obligation benefits, and the possibility for credit rating structure. These benefits make cars and truck financing an appealing option for people seeking to purchase an automobile without having to pay the sum total upfront. Consider discovering vehicle financing options to make owning your dream auto a truth.

Auto financing uses people the opportunity to get a car with a reduced first financial worry than outright investing in.For those who appreciate the workmanship, advanced features, and reputation linked with luxury automobile brand names, car financing supplies a pathway to driving these preferable lorries. For people who use the automobile for organization functions, such as freelance people or those that utilize their vehicle for job-related travel, the rate of interest paid on the auto lending might be tax-deductible.In verdict, car financing provides various benefits such as lower initial financial concern, accessibility to higher-end vehicles, flexible payment options, potential tax advantages, and the possibility for credit scores building. Consider exploring vehicle financing alternatives to make possessing your desire cars and truck a truth.

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Danny Pintauro Then & Now!

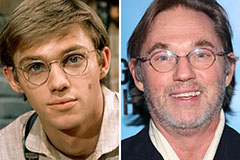

Danny Pintauro Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!